- Home

- About

- Attorneys

- Practice Areas

- Divorce

- 10 Signs Your Wife May Be Planning to Divorce You and What You Can Do to Avoid Losing Everything

- How to Protect Yourself and Your Assets in a Contentious Divorce in San Antonio, TX

- Can My Wife Ask Me to Leave My House After She Files for Divorce?

- Will My Wife Keep Military Benefits After the Divorce Is Final?

- Child Custody

- Child Support

- What is the Maximum Amount of Child Support?

- Child Support with 50/50 Custody

- What Are Custody and Support Modifications and How Do They Work in Texas? What Are the Circumstances Needed?

- Will There Still Be Child Support With Joint Custody?

- Child Support Enforcement and Custody Enforcement Lawyers Helping You

- Adoptions

- Family Law

- Father’s Rights

- Texas Military Family Lawyer

- Texas Military Paternity Suits

- SAPCR Law

- Prenuptial and Postnuptial Agreements

- Visitation

- Divorce

- Blog

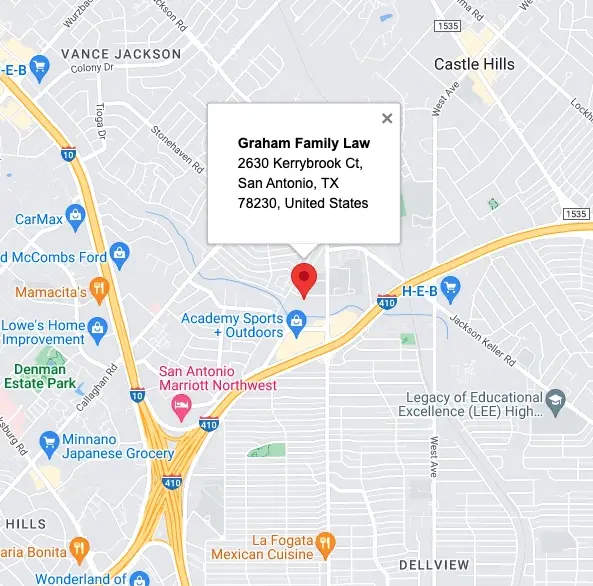

- Contact Us

- Home

- About

- Attorneys

- Practice Areas

- Divorce

- 10 Signs Your Wife May Be Planning to Divorce You and What You Can Do to Avoid Losing Everything

- How to Protect Yourself and Your Assets in a Contentious Divorce in San Antonio, TX

- Can My Wife Ask Me to Leave My House After She Files for Divorce?

- Will My Wife Keep Military Benefits After the Divorce Is Final?

- Child Custody

- Child Support

- What is the Maximum Amount of Child Support?

- Child Support with 50/50 Custody

- What Are Custody and Support Modifications and How Do They Work in Texas? What Are the Circumstances Needed?

- Will There Still Be Child Support With Joint Custody?

- Child Support Enforcement and Custody Enforcement Lawyers Helping You

- Adoptions

- Family Law

- Father’s Rights

- Texas Military Family Lawyer

- Texas Military Paternity Suits

- SAPCR Law

- Prenuptial and Postnuptial Agreements

- Visitation

- Divorce

- Blog

- Contact Us

CALL NOW! 210-308-6448